-15% Discount until February 28th!

Online Master in Finance

Chosen among the best in the world by the QS Stars Ranking 2026

The Online Master in Financial Management at Universidad Europea equips you with the skills, knowledge, and practical experience to thrive in today’s dynamic financial world.

- Strategic Decision-Making: learn to make high-impact decisions that drive business growth and sustainability.

- Cutting-Edge Technologies: master the latest financial tools and technologies shaping the industry.

- Sustainable Investments: gain expertise in responsible investing and long-term value creation.

- Investor Relations & Communication: enhance your ability to manage investor relationships and communicate financial insights effectively.

- Flexible Learning: attend live classes or access recordings anytime, seamlessly balancing study with your professional life.

- Learn from Experts: benefit from real-world insights from professionals at Fintech Spain, Indra, Allianz Group, and Pan Hispano.

- Hands-On Experience: work with real-life cases to build confidence, strategic vision, and practical problem-solving skills.

*Degree verified in online format in Spanish, pending a favorable report from the Regional Evaluation Agency.

Official degree issued by Universidad Europea de Madrid

| Online with live classes | Start: October 2026 | 10 months, 60 ECTS | Faculty of Economics, Business and Communication Sciences |

Universidad Europea is a yes

Yes to the best academic quality

Learn in small groups, where your teachers know who you are and classes are dynamic with real-life cases. Work with the real world, with complete cases or AI software and tools.

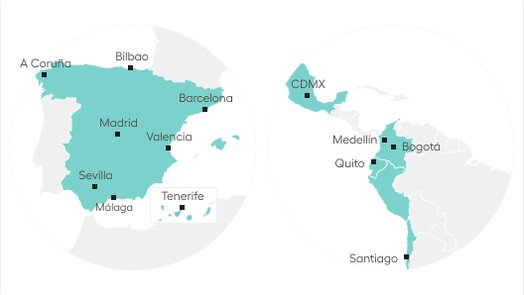

Yes to an internationally renowned university

We are a university with more than 30 years of experience, campuses in Spain and Portugal, and endorsed by the most recognised international rankings and seals, such as QS and THE.

Study with the number one university network in Spain.

Yes to real professional connections

Our employability team and job hunters help you boost your career, and our professors, who are active professionals at leading companies such as Google, Amazon, and PwC, connect you with the professional industry.

Adapt successfully to a changing world.

ECOFinance Workshops

Boost your financial future with sustainable strategies, learn about new trends, tools, and the future of sustainability in finance.

Financial HUB

Learn with the most innovative technology

The quality you deserve

Our professors combine teaching with professional practice to bring the latest trends and methodologies from the industry into the classroom.

Study on a virtual campus with a practical and versatile environment that allows you to balance your studies with your personal and professional life.

Universidad Europea has earned a 5-star rating in employability and overall quality, according to the leading global indicator that evaluates the quality and competitiveness of universities worldwide.

90% of our graduates find employment within 12 months of completing their studies.

Syllabus for the online Master's degree in Financial Management

Study plan structure

Syllabus

PRIMER CURSO

| Module | ECTS | Type | Language |

|---|---|---|---|

| Module I. Financial Management and Financial Markets | 6 | Compulsory | English (En) |

| Module II. Financial Planning and Management Control Technologies | 6 | Compulsory | English (En) |

| Module III. Financial Management and Investment Assessment | 6 | Compulsory | English (En) |

| Module IV. Corporate Financial Taxation | 6 | Compulsory | English (En) |

| Module V. Corporate Asset Management | 6 | Compulsory | English (En) |

| Module VI. Corporate Finance | 6 | Compulsory | English (En) |

| Module VII. Risk Analysis and Control Tools | 6 | Compulsory | English (En) |

| Module VIII. Finance and Information Management (Big Data, Business Analytics, Fintech) | 6 | Compulsory | English (En) |

| Module IX. Professional Internships | 6 | Compulsory | English (En) |

| Module X. Final Master’s Project | 6 | Compulsory | English (En) |

Partners

We have agreements with leading companies in the sector that participate by giving classes and workshops, developing programme content and facilitating the creation of a networking platform for our students.

The Career Services Department at the European University will advise and assist you in your professional career so that you can achieve all your goals.

More information

Degree Implementation Schedule

Academic year 2022/2023.

Graduate profile

The graduate profile of this program means that the student acquires the knowledge, skills, and competencies necessary to perform various professional activities in the financial field, such as:

- Financial management and administration.

- Executive roles in public and private banks.

- Financial advisory or investment portfolio management.

In addition, the student will be prepared to work as a high-level professional in financial departments, as a “financial controller,” or as the person responsible for these areas, as well as an expert in specialized areas.

Professional internships

Internships in companies are a key element of your training. Gaining experience after learning in your degree program is the best way to enter the job market. There are two types of internships: curricular (included in your study plan) and extracurricular (which you can do voluntarily).

These internships involve monitoring by the company and the internship professor. Activities will be coordinated by the professor-tutor responsible for internships and external agreements at UEM, who will liaise with the company and oversee the student’s performance during the internship. The professor acts as a link between the student and any professional doubts that may arise. The tutor is responsible for issuing an evaluation report based on the information provided by the company and the student’s academic internship report.

If you want to improve your job prospects before finishing your university studies, you can do extracurricular internships. You can do them in any course, but we remind you that internships are a complementary training activity to your studies; therefore, the more knowledge you have acquired throughout your degree, the more you will benefit from the internship experience.

Number of places for incoming students

100.

Learning and training process outcomes

Knowledge

- KON1. Identify the national and international regulatory systems of financial markets and instruments, enabling more accurate suitability in financial decision-making.

- KON2. Recognize the instruments of financial planning, analysis, and assessment of the financial situation and corporate investments.

- KON3. Identify strategies for inorganic growth/business restructuring, based on the identification of risks and tax optimization strategies.

- KON4. Identify the main technological, IT, and financial (Fintech) tools currently used in the financial sector.

Skills

- SAB1. Evaluate the implications and consequences of regulations and rules governing financial markets and instruments within a company or organization.

- SAB2. Perform the analysis of the macroeconomic environment, financial statements, and corporate investments.

- SAB3. Apply financial strategies that allow for increasing business results.

- SAB4. Design methods for data extraction from databases (Big Data), applying Business Intelligence and Fintech techniques.

Competencies

- COMP1. Examine and interpret the competitive environment of the company and the key elements of management and strategic planning, as well as the value creation process.

- COMP2. Analyze the macroeconomic environment, examining the structure of the international financial system.

- COMP3. Select the most appropriate IT tools for extracting information from databases to support decision-making in global uncertainty environments.

- COMP4. Analyze and interpret the company’s financial statements and their limitations for business decision-making.

- COMP5. Evaluate the investment selection criteria, the net present value of generated funds, and the required rate of return, for decision-making at the financial management level regarding investments.

- COMP6. Make decisions at the financial management level regarding the optimal capital structure, as well as shareholder remuneration methods (dividend policy).

- COMP7. Develop and prepare the company’s financial plan, understanding budget planning processes and applying forecasting techniques and strategies.

- COMP8. Apply and adapt technological management control tools, choosing systems, applications, and methodologies that assist in data recording, process control and improvement, and data consolidation for decision-making.

- COMP9. Develop a practical vision of the tax implications of business decisions, optimization strategies, tax burden, and financial-tax profitability of different investment alternatives.

- COMP10. Examine the national and international regulatory systems applicable in the financial sector, evaluating the consequences of their application and non-compliance, especially the Markets in Financial Instruments Directive (MiFID II).

- COMP11. Use and evaluate portfolio management and optimization techniques, designed according to expected results.

- COMP12. Evaluate and differentiate the different types of business projects, their sources of financing, as well as calculate the weighted average cost of capital (WACC).

- COMP13. Analyze and interpret inorganic growth processes through mergers and acquisitions (M&A) and business restructuring processes such as venture capital and private equity.

- COMP14. Manage the different types of risk, applying hedging strategies and derivative products (futures, options, SWAPs, FRAs, currency insurance).

- COMP15. Use financial technology (FinTech) tools and business analytics techniques for financial decision-making.

- COMP16. Apply the knowledge, skills, and competencies acquired in professional environments involving financial management, supervision (internal control), consulting (financial, accounting, business valuation, investment analysis), and financial intermediation.

- COMP17. Apply the knowledge, skills, and competencies globally and integratively in the practical and systematic development of a final master’s project (essay, consulting work, research paper, etc.), focusing on decision-making related to financial management, and defend it before a panel.

- COMP18. Demonstrate ethical behavior and social commitment in the performance of professional activities, as well as sensitivity to inequality and diversity.

Universidad Europea Online: leaders in innovation and educational quality

- Flexible and tailored to you: Universidad Europea’s online methodology allows you to adapt your studies to your personal circumstances.

- Experiential: a learning approach based on continuous practice and real-life cases in simulated environments that prepares you to face professional challenges.

- Constant communication: with the latest information technologies, you’ll stay in direct contact with the university, your professors, and your classmates.

- Continuous support: your professors and tutor will answer your questions and guide you through every stage of your learning journey.

Our educational model

At Universidad Europea we are committed to learning that prepares you for the needs of the professional world. Thanks to our methodology you will be able to acquire the knowledge, skills, abilities and competencies that facilitate maximum employability in a global world.

Access

Recommended profile

The Master’s program is aimed at students with the following entry profile: Graduates, Diploma holders, or Degree holders in Business Administration and Management, Economics, Actuarial and Financial Sciences, Business Studies, Accounting and Finance, or their foreign equivalents.

Admission requirements

- Official university degree issued in Spain or by another higher education institution belonging to a member state of the EEES.

- Degree from educational systems outside the EEES without the need for official recognition, subject to verification by the university that the level of training is equivalent to the corresponding official Spanish university degrees, and that the degree grants access to postgraduate studies in the country of issuance.

- English B2 Level.

Admissions process

The admission process to pursue an online undergraduate or postgraduate certificate at Universidad Europea can be carried out throughout the year, although enrolment on any of our programmes is subject to availability. In order to complete the process, follow these simple steps:

1

Documentation

You will need to send the specific documentation to your personal advisor

- Admissions form.

- Legal document required for accessing the programme

- Photocopy of your ID.

- Curriculum vitae.

2

Admissions test

Once your documentation has been reviewed, your personal advisor will contact you.

- Competency assessment test.

- Personal interview.

- Language assessment test (B2).

3

Reserving a place

Formalising the reservation of a place through our different methods of payment

- Direct debit.

- Credit card.

- Online payment.

Leading Faculty

50% of the faculty is made up of PhD holders.

Dr. Óscar Cordero Mata

Director of the Official Master’s Degree in Financial Management and Administration at Universidad Europea. Bachelor’s Degree in Economics. Master’s Degree in Economics and Innovation Management. Master’s Degree in Development and Cooperation. PhD in Economics and Innovation Management. His professional background includes the management and leadership of companies in national and regional projects.

Meet our faculty of active professionals

- Dr. Oscar Cordero Mata

Director of the Master’s in Financial Management and Administration at Universidad Europea. Degree in Economics. Master’s in Economics and Innovation Management. Master’s in Development and Cooperation. Ph.D. in Economics and Innovation Management. His professional career includes management and leadership of companies in national and regional projects. - Dr. Francisco Pérez Hernández

Degree in Business Administration and Management (University of Guadalajara, Mexico). Master’s in Financial Markets (Université Paris-Dauphine and Centro Internacional Carlos V). Ph.D. in Applied Economic Modeling (Universidad Autónoma de Madrid). Over 15 years of professional experience in capital markets, financial risk, and financial consulting. Currently Senior Director of Risk and Treasury at Indra. - D. Pablo Blasco Bocigas

Professor of the Master in FinTech & Blockchain and the Master in Financial Management at Universidad Europea. Author of the first book in Spanish on the FinTech banking ecosystem and the first MOOC in Spain on FinTech and the future of banking. Founder and Director of FinTech Spain. - Dr. Rafael Hurtado Coll

Regular lecturer at various universities and academic institutions. Director of Investments and Strategy at the Asset Management Unit of ALLIANZ SEGUROS. Over 25 years of professional experience and more than 100 publications in books, journals, and specialized media on finance and corporate economics. Co-author of the book Alternative Investments: Other Ways to Manage Profitability. - Dr. Javier Rodríguez Luengo

Since October 2019, associate professor of taxation, corporate tax regime, and Spanish and global economy. Author of books, working papers, and articles in scientific and specialized journals. Consultant for the Institute of Fiscal Studies (2005, 2003, 2001). Research associate at the UN Economic Commission for Latin America and the Caribbean in the Division of Environment and Human Settlements in Santiago de Chile (2001). Research associate at the European Commission’s Directorate-General for Internal Market in Brussels (1999). - D. Sergio García Codina

Academic background in international management, general management, and human resources management, with specializations in financial management. Works as an independent consultant and trainer in financial and business strategy. Professional experience as financial analyst and head of treasury in companies such as Volkswagen, ONO, and Futura International Airways. Former financial director at Pan Hispano, Grupo GPB, and Privilege Style Airways

Excellence endorsed by the best

Frecuently Asked Questions

Where can you study the Online Master’s in Financial Management with live classes?

At Universidad Europea de Madrid, you can take the Master’s in Financial Management 100% online. Weekly classes are delivered live and also recorded, so you can watch them anytime. You access the content from the virtual campus on any device, and the program grants an official UEM degree.

What complementary activities or content reinforce your online learning?

The program includes thematic workshops (e.g., Sustainable Finance/ESG) and access to a Financial Hub with activities on emerging markets. These activities are designed to strengthen your learning in a digital and practical environment.

Is UEM highly rated for online teaching?

Yes. Universidad Europea de Madrid has 5/5 QS Stars in online teaching and employability, a seal that guarantees the quality of its digital experience.

How is the Online Master’s in Financial Management assessed?

Assessment is carried out continuously, combining case studies, projects, and scheduled tests. Guidelines and rubrics are available on the virtual campus, and each subject specifies dates and criteria in its syllabus.

Can you do internships from another city or country while studying the Online Master’s in Financial Management?

Yes, as long as you comply with the regulations and internship agreement. You must coordinate with the Admissions team and the internship service, and confirm schedules and time zones with the company.

How is teamwork organized in the Online Master’s in Financial Management?

Teamwork is carried out through shared virtual spaces for documents and meetings. Each student records agreements and roles within the group, and evaluation considers both individual contribution and the final project result.

How do you receive quick feedback in the Online Master’s in Financial Management?

Faculty provides feedback via messaging within a maximum of 48 hours and through scheduled tutorials. Comments and rubrics are displayed directly on your submissions. Activate virtual campus notifications so you don’t miss any responses.